John Bozzella, president and CEO of Alliance for Automotive Innovation, today released the following statement on final rules from the Departments of Treasury and Energy (required by Congress) related to the EV consumer tax credit (30D) and critical mineral supply chains

“I’ve talked about the importance of the EV consumer tax credit… even while lamenting that it’s still hard to get – about 20 percent of EVs for sale today and slated to get even more restrictive in the years ahead.

“The EV transition requires nothing short of a complete transformation of the U.S. industrial base. That’s a monumental task that won’t – and can’t – happen overnight.

“This updated guidance from the Treasury Department is something we recommended. It makes good sense for investment, job creation and consumer EV adoption.

“Imagine an EV that complied with all IRA eligibility requirements but is kicked out of the program because of a trace amount of a critical mineral from an FEOC? That makes no sense – especially when you consider the massive investments automakers and suppliers are making in domestic EV manufacturing.

“The Treasury rules appear to recognize the realities of the global supply chain by providing some temporary flexibility in terms of where the critical minerals in EV batteries can be sourced. That’s helpful as more automotive supply chains and battery production is localized to the U.S. and our allies.”

Inflation Reduction Act – 30D EV Tax Credit:

There are about 114 EV models currently for sale in the U.S.

-

22 models qualify for the 30D tax credit.

-

9 models eligible for $3,750 credit.

-

13 models eligible for the full $7,500.

-

Qualifying vehicles HERE.

The 30D EV tax credit provides up to $7,500 off the cost of a qualifying EV. There are income limits for buyers and strict rules for the vehicles and batteries:

- The EV must be assembled in North America and the MSRP is capped ($55,000 or less for an electric sedan, $80,000 or less for an electric SUV or truck).

There are also complex critical mineral and battery sourcing requirements:

- Congress split the $7,500 tax credit in half and based eligibility on a battery electric, plug-in electric or fuel cell vehicle meeting rules related to the origin of the battery’s critical minerals and components.

- In 2024, 50 percent of the critical minerals in the EV battery must be extracted or processed in the U.S. – or a country with a U.S. free trade agreement. Pass this test, the credit is worth $3,750.

- In 2024, 60 percent of the battery components must be manufactured or assembled in North America. That’s the other $3,750.

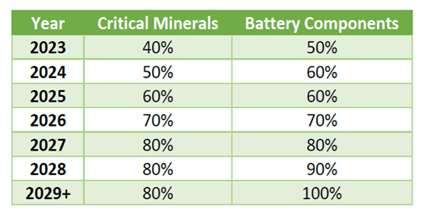

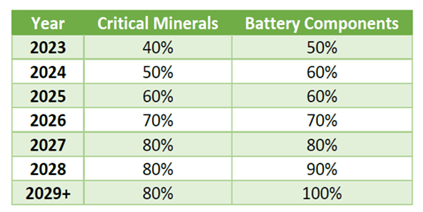

Both thresholds ramp up in the coming years (topping out at 80 percent for minerals and 100 percent for components). Cheat sheet below:

-

In 2024, the Treasury Department prohibits the 30D tax credit for a new EV that contains battery components from a Foreign Entity of Concern (FEOC). In 2025, the FEOC restriction applies to critical minerals.

-

This FEOC guidance helps the auto industry better understand what EVs might be eligible for the tax credit next year – and beyond.

SOURCE: Alliance for Automotive Innovation